April 15, 2025

– 8 minute read

Learn how to manage loyalty program liability with strategies to track points, reduce costs, and ensure financial stability while enhancing customer engagement.

Cormac O’Sullivan

Author

Loyalty programs drive customer loyalty, boost engagement, and increase customer lifetime value. Yet, every loyalty point earned carries a financial commitment known as loyalty program liability, impacting your balance sheets. Understanding this important aspect is key to maintaining financial health while rewarding customers effectively. Done right, programs strengthen connections and growth; done poorly, they create hidden costs that can harm profitability.

What is Loyalty Program Liability?

Loyalty program liability is the financial obligation a business assumes when customers earn points or rewards. Recorded on balance sheets, it reflects outstanding points and potential redemption costs. Managing this liability ensures financial health, compliance, and sustainable customer loyalty, turning points into strategic business value.

Accounting for Rewards Programs

Accounting for loyalty and rewards programs requires treating the points customers earn as a separate performance obligation. This means that when a customer makes a purchase and earns points, part of the transaction revenue cannot be recognized immediately.

Revenue Allocation Under ASC 606

Under ASC 606, loyalty points earned in a transaction are treated as a separate performance obligation. This means the total transaction price must be divided between the purchased product or service and the loyalty points issued to the customer. The portion attributed to the points cannot be recognized immediately and must instead be recorded as deferred revenue.

Recognition of Deferred Revenue

Deferred revenue related to loyalty points is only recognized as earned revenue when the company fulfills its obligation. This occurs either when the customer redeems their points and receives the associated reward or when the points expire, and the company is no longer required to provide a benefit.

Regional Variations

Accounting requirements for loyalty programs differ across jurisdictions. While ASC 606 provides a widely adopted framework, companies must ensure they follow the standards and regulations applicable to their geographic location.

5 Strategies to Reduce Loyalty Program Liability

Driving Stronger Customer Participation

Increasing customer participation encourages more frequent point redemption, which gradually reduces the volume of outstanding liabilities. When customers are consistently reminded of the program’s value, they are more likely to engage with available rewards. Personalised communication, targeted offers, and accessible redemption options help reinforce this behaviour. Over time, higher engagement stabilises liability and strengthens overall program performance.

Accelerating Redemption Activity

Encouraging earlier redemption helps prevent large accumulations of dormant points that inflate liability. Companies can motivate customers by introducing limited-time promotions, bonus redemption periods, or temporarily reduced reward thresholds. These incentives create a sense of urgency and make redemption more appealing. As customers redeem more frequently, the financial responsibility tied to unredeemed points becomes easier to manage.

Implementing Point Expiration Policies

A well-designed expiry policy prevents points from remaining on the balance sheet indefinitely, helping manage liability in a predictable way. Expiration must be communicated clearly and far in advance to ensure customers perceive it as fair rather than punitive. When paired with reminders or pre-expiry incentives, expiry dates can also encourage timely redemption. This approach reduces long-term liability while maintaining a positive customer experience.

Controlling Reward Delivery Costs

Managing the cost associated with each redeemed point is essential for maintaining financial sustainability. Companies can negotiate better rates with partners, refine their reward catalogue, or introduce alternatives that offer high perceived value at lower cost. These adjustments allow the business to deliver appealing rewards without eroding margins. As cost per point decreases, the overall liability becomes less burdensome to the organisation.

Balancing Earning and Redemption Dynamics

A well-balanced loyalty program ensures that points are earned at a rate customers find motivating while still encouraging consistent redemption. If earning is too easy and redemption too difficult, liability can grow faster than expected. Conversely, a balanced structure supports steady engagement and predictable financial outcomes. Aligning program rules with customer behaviour helps maintain a healthy equilibrium between liability, value, and customer satisfaction.

5 Key Terms to Know When Assessing Loyalty Liability

Contract Liability

Contract liability represents the company’s obligation to deliver future goods or services in exchange for points customers have earned. When points are issued, the company has effectively received consideration for a promise it has not yet fulfilled. This amount remains as a liability on the balance sheet until the customer redeems their points. Once the obligation is met—or the points expire—the liability is released and recognised as revenue.

Revenue Recognition

Revenue recognition in loyalty programs can be complex due to the need to separate the value of the purchased product from the value of the points issued. Under ASC 606, companies must defer a portion of the transaction price associated with loyalty points until the reward obligation is satisfied. This ensures that revenue is recognised only when the company delivers the benefit tied to those points. Such an approach creates a more accurate reflection of the company’s financial position over time.

Fair Value

Fair value refers to the estimated value of the reward a customer can obtain with their points, and it is a critical input in calculating liability. Determining fair value requires analysing reward types, customer preferences, geographic differences, and expected redemption rates. Since reward costs and customer behaviour evolve, fair value estimates need to be reviewed regularly. This ensures the liability recorded remains aligned with actual program economics.

Deferred Revenue

Deferred revenue captures the portion of loyalty-related revenue that cannot be recognised until the company satisfies its performance obligation. When customers earn points, the value allocated to those points is recorded as deferred revenue rather than immediate income. This balance decreases when points are redeemed or expire, allowing revenue to be recognised appropriately. Maintaining accurate deferred revenue reporting is essential for financial transparency and regulatory compliance.

Transaction Price

Transaction price refers to the total amount of consideration the company expects to receive from a customer in exchange for goods or services. In loyalty programs, this price must be split between the delivered product and the loyalty points issued. The portion attributed to points becomes a liability until the customer uses or forfeits them. Proper allocation ensures the company presents an accurate financial picture and avoids overstating immediate revenue.

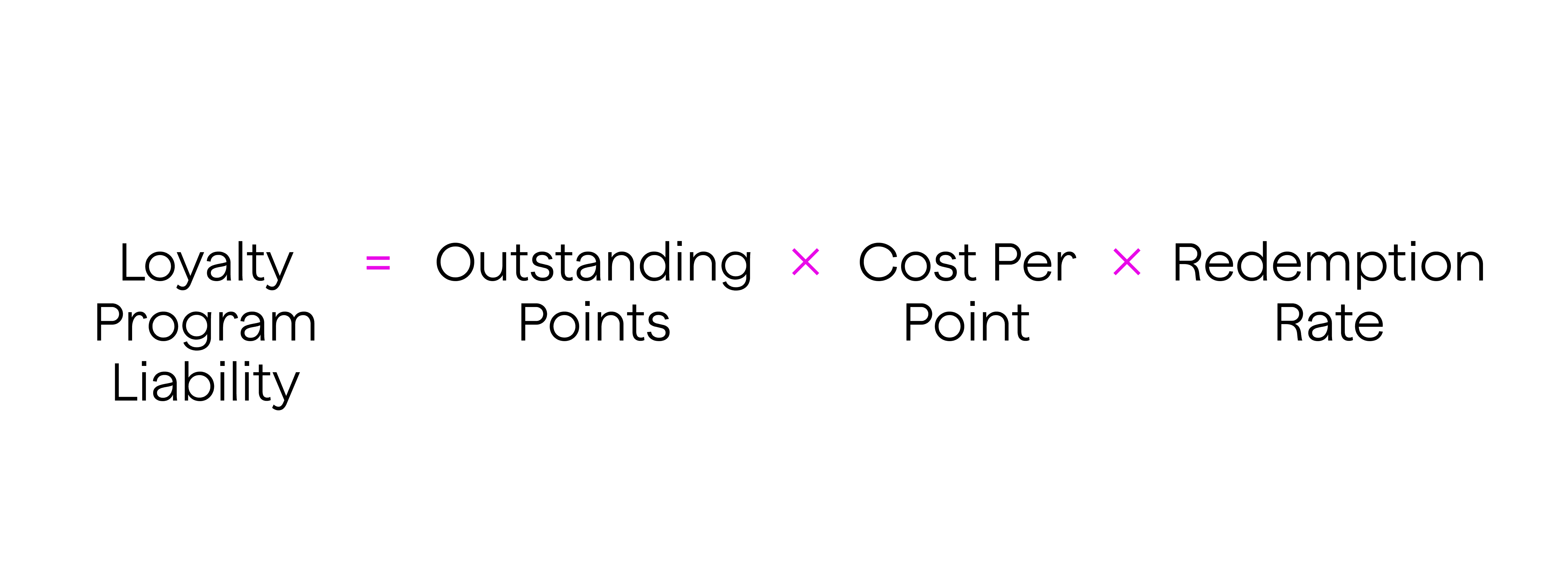

Calculating Loyalty Program Liability

Calculating loyalty program liability involves estimating the future cost of all unredeemed points. This requires analyzing both financial inputs and customer behavior patterns. The key components include:

Outstanding Points

This represents the total number of points customers have earned but have not yet redeemed. Outstanding points form the base of the liability calculation because each point carries potential future cost.

Redemption Rate

The redemption rate reflects the percentage of points customers are expected to redeem. It is typically based on historical behavior, program engagement, and seasonal or campaign-driven fluctuations. A higher redemption rate increases the estimated liability.

Cost per Point

This is the amount the company spends when a point is redeemed. It may differ depending on the reward type, supplier costs, or partnerships. Accurately determining cost per point is essential for forecasting liability.

Because customer behavior and redemption patterns shift over time, the loyalty liability calculation must be regularly updated. Frequent recalculations ensure the balance sheet reflects the company’s most accurate future obligations.

The Formula: Outstanding Points x Cost Per Point x Redemption Rate

Managing and Monitoring Loyalty Program Liability

Ongoing Program Oversight

Regular monitoring of loyalty program activity is essential for maintaining accurate liability estimates. This involves tracking outstanding points, redemption patterns, customer engagement levels, and any shifts in program usage. Consistent oversight helps identify trends early, allowing companies to adjust forecasts before liabilities grow unexpectedly. Over time, this practice supports more reliable financial planning and program optimisation.

Implementing a Strong Accounting Framework

A well-designed accounting system is crucial for handling the complexities of loyalty program liability. It must be capable of allocating transaction prices, managing deferred revenue, and recognising revenue when obligations are fulfilled. Systems that automate these processes reduce the risk of error and ensure compliance with accounting standards. By capturing detailed program data, they also enable more accurate and dynamic liability calculations.

Leveraging Predictive Modelling

Predictive analytics offers valuable insight into how customers are likely to redeem their points in the future. By analysing historical behaviour, seasonal trends, and customer segmentation, companies can develop more accurate redemption forecasts. These predictions help refine liability calculations and inform strategic decisions related to program design. Leveraging such data-driven models creates a more proactive approach to financial management.

Conducting Regular Liability Audits

Conducting regular audits ensures that recorded liabilities accurately reflect the company’s actual obligations. Audits can uncover discrepancies, outdated assumptions, or gaps in data that may distort liability estimates. They also validate whether financial reporting aligns with internal policies and external regulations. When performed consistently, audits help maintain transparency and strengthen trust in the organisation’s financial statements.

Conclusion

Loyalty program liability is more than an accounting detail; it’s a strategic element of effective customer engagement. Properly managing liabilities ensures compliance, supports smarter financial decisions, and strengthens customer loyalty.

By tracking outstanding points, analyzing redemption behavior, and optimizing loyalty rewards, businesses can turn potential financial obligations into opportunities for growth. A well-managed loyalty program balances value for customers with sustainable financial health, driving long-term success and stronger customer lifetime value.